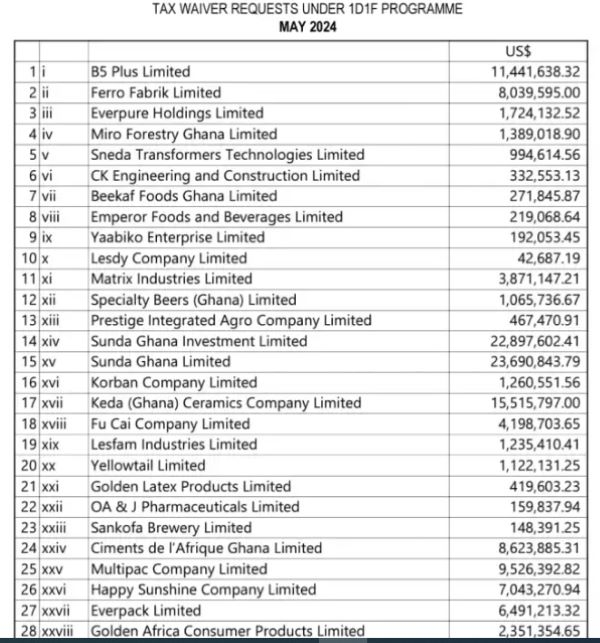

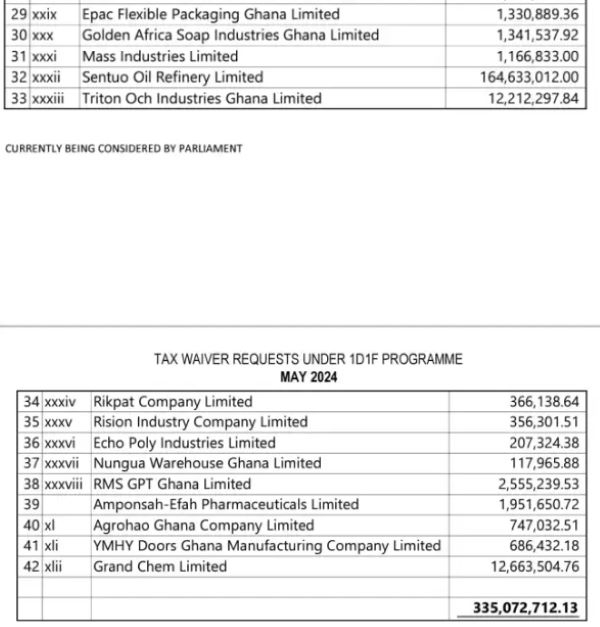

See all the 42 1D1F companies to benefit from $335m tax waiver

The tax waivers amount to over $335 million

The tax waivers amount to over $335 million

Under Ghana's New Patriotic Party (NPP) government's flagship One District One Factory (1D1F) policy, 42 companies are awaiting parliamentary approval for tax waivers amounting to over $335 million.

In 2021, the Ministry of Finance initiated efforts to secure approximately $335 million in tax exemptions for these companies, part of the 1D1F initiative.

These exemptions fall under the Exemptions Act, 2022 (Act 1083), presented to Parliament by former Finance Minister Ken Ofori-Atta.

Among the beneficiaries is the newly established Sentuo Oil Refinery Limited, set to receive the largest exemption of $164.6 million.

The 1D1F initiative aims to transform Ghana’s economy from one reliant on raw material imports and exports to a manufacturing and value-added export economy.

This private sector-led initiative involves government support to enable businesses to secure funding and additional assistance from government agencies to establish factories.

However, even before the request is considered by Parliament, the Minority has expressed its intention to block the move.

Minority Leader Dr Cassiel Ato Forson criticised the exemptions.

Dr Forson stated, "It is the considered view of the Minority that these requests for tax exemptions running into several billions of cedis, are unconscionable, inordinate and bear all the trappings of organised crime…We in the Minority are serving notice that we shall resist these tax waiver applications fiercely! In their current forms, we shall resist each and every one of the tax waiver applications with all the tools and strategies at our disposal.”

He also added that “the phenomenon of tax exemption as an avenue for corruption is a frightening development that threatens the domestic revenue reforms that the state is currently undertaking … The effect of these new taxes will result in the poor becoming poorer, suffocating industries and businesses and further increasing the hardships Ghanaians are already experiencing. This government is simply robbing Peter to pay Paul by exacting taxes from Ghanaians, only to dole out huge tax exemptions to their cronies for kickbacks. It is for this reason that we call on all Ghanaians to join us in this fight.”

See the list below:

.

Source: ClassFMonline.com

Trending News

GES boss opens smart classroom block at OWASS under digital learning initiative

08:44

Uphold integrity, patriotism and shun eye-service – Ing Lamptey urges GWCL staff

13:39

First Lady praises Ghanasco on the launch of 65th anniversary

11:36

Minority boycotts proceedings to demand release of Wontumi from EOCO custody

15:31

E/R: Suhum MA Experimental C Basic School wins the 3rd Edition of ADVAG 2024 Maths and Science Quiz

10:42

Western Regional Minister orders urgent protection of Daboase water treatment plant buffer zones

09:22

Achiase DCE appeals to Army Chief for annual military recruitment slots for locals

17:19

Omane Boamah rallies global partners to help build "The Africa We Want" at LSE Futures Forum

12:48

TPMC to partner with security agencies to crack down on unlicensed traditional medicine practitioners

11:00

Annoh-Dompreh makes strong case for election of MMDCEs on floor of Parliament

14:18