BoG revises mobile money transaction limits

In 2023, the total value of mobile money transactions in Ghana reached a record level, soaring to GH¢1.912 trillion

In 2023, the total value of mobile money transactions in Ghana reached a record level, soaring to GH¢1.912 trillion

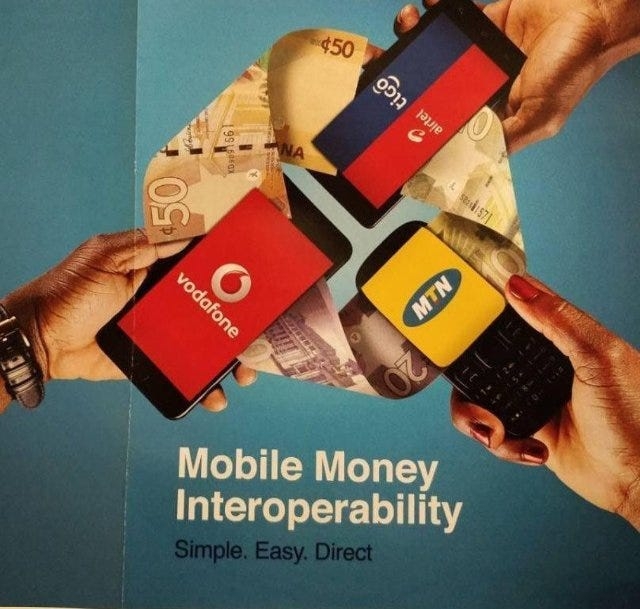

The Bank of Ghana (BoG) has announced an upward revision of balance and transaction limits for customers' mobile money wallets, effective 1 March 2024.

According to a statement from the Ghana Chamber of Telecommunications, this adjustment aligns with the growing trends of transactional activities and evolving customer demands.

Under the new limits, daily transaction caps have been raised: from GH¢2,000 to GH¢3,000 for minimum accounts, GH¢10,000 to GH¢15,000 for medium accounts, and GH¢15,000 to GH¢25,000 for enhanced accounts.

Similarly, maximum daily transaction limits have been increased: from GH¢3,000 to GH¢5,000 for minimum accounts, GH¢25,000 to GH¢40,000 for medium accounts, and GH¢50,000 to GH¢75,000 for enhanced accounts.

In terms of monthly transaction limits, minimum accounts will see an increase from GH¢6,000 to GH¢10,000. However, there are no changes for medium and enhanced accounts, which previously had no limits on monthly transaction values.

The statement concluded by advising customers to contact their service providers' customer service centres nationwide for any necessary clarifications.

In 2023, the total value of mobile money transactions in Ghana reached a record level, soaring to GH¢1.912 trillion, as revealed in the January 2024 Summary of Economic and Financial Data by the Bank of Ghana.

This marked a substantial increase from GH¢1.07 trillion in 2022.

The data disclosed that by the end of the first 10 months of 2023, total Mobile Money transactions had already reached GH¢1.527 trillion.December 2023 recorded the highest monthly transaction value, reaching GH¢199.3 billion.

Throughout that year, mobile money transactions consistently surged, with all 12 months surpassing GH¢100 billion each. In January 2023, the value stood at GH¢130.1 billion, compared to GH¢76.2 billion in the same period in 2022.

October 2023 set a record with transactions hitting GH¢179.2 billion.

Despite this performance, it remains unclear whether the government is meeting the Electronic Transfer Levy (E-Levy) target for 2023, given the current E-Levy rate of 1.0%.

Source: ClassFMonline.com

Trending News

I was surprised over exclusion from ministerial position in Akufo-Addo's second term-Atta Kyea

12:21

NDC annuls Amenfi Central Parliamentary primary

17:55

NDC's ORAL Brigade clashes with security at Finance Ministry

15:40

Walewale NPP parliamentary primary re-run to take place Sept. 8

14:56

Alan Kyerematen wins Zongos with Zumunta launch

08:36

Settle Ghana slams Atta Kyea for defending President Akufo -Addo on failed galamsey fight

14:09

O'Reilly SHS student murder: Suspect remanded for two weeks

16:23

NE/R: NPP suspends two executives in Walewale over allegations of gross misconduct

15:01

AG calls for global unity in tackling cross-border financial crimes

12:36

FDA warns public against palm oil laced with ‘Sudan IV’

14:47