Ghana’s foreign exchange reserves remains steady, reported at $6.2bn as of April 5 – BoG Governor at joint IMF, MoF presser

Dr Ernest Addison - Governor BoG

Dr Ernest Addison - Governor BoG

Ghana's foreign exchange reserve buffers have continued to strengthen, with improvements seen in the current account balance, according to Dr. Ernest Addison, Governor of the Bank of Ghana (BoG).

Dr. Addison stated, "despite the delays in disbursement of some donor support, our foreign exchange reserves have remained steady and are reported at $6.2 billion as of 5th April 2024."

Highlighting the central bank's commitment to sustaining this progress, Dr. Addison mentioned the implementation of policies such as the innovative Gold for Reserves programme, which has significantly impacted Ghana's foreign exchange management strategies.

Speaking at a joint press conference with the International Monetary Fund (IMF) and the Ministry of Finance (MoF) regarding the second review of the Extended Credit Facility (ECF) Programme, Dr. Addison noted several key developments. These include addressing issues related to the impact of the DDEP on the BoG's balance sheet and reaching a broad understanding on the early recapitalization of the BoG. A Memorandum of Understanding between the BoG and the Ministry of Finance will be signed to formalize this agreement.

Additionally, Dr Addison said discussions were held on progress in the External Debt restructuring programme of the Government, including ongoing negotiations with Commercial Creditors, Bondholders, and bilateral creditors.

Dr. Addison emphasised the importance of steadfast programme implementation, fiscal rectitude, tight monetary policy stance, and necessary structural reforms to sustain the progress made. He expressed expectations for flexibility from the IMF to accommodate changing dynamics in the Ghanaian economy.

Acknowledging past challenges in implementing IMF-supported programmes during election years, Dr. Addison affirmed the commitment of the Government and the Central Bank to alter this narrative.

He stressed the significance of continued macroeconomic stability and an early return to the capital markets, reaffirming their dedication to firm programme implementation.

Trending News

NE/R: Curfew imposed on Nalerigu township

19:15

Ho and Hohoe earmarked for metropolitan status as government unveils Oxygen City housing project

23:14

Tse-Addo lands: Presidency petitioned over alleged actions of Interior Minister

16:19

President Mahama calls on ECOWAS to commit to dialogue and engagement with Sahel States

18:48

Concerned NDC members in Larabanga petition President Mahama over marginalisation

18:05

Housing Project: President Mahama launches Oxygen City in Volta, reaffirms commitment to equitable regional development

23:20

Citizen Ato Dadzie praises Lordina Mahama's humility

16:05

Yoruba Kingdom honours Prez. Mahama for global leadership

15:28

Environmental Protection (Mining in Forest Reserves) Revocation Instrument takes effect after 21 days

17:47

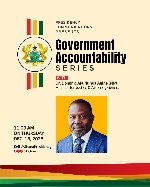

'Government Accountability Series': Attorney General, Justice Minister speaks tomorrow Dec 18

20:02