Bank of Ghana calls for responsible media role in resetting Ghana’s economy

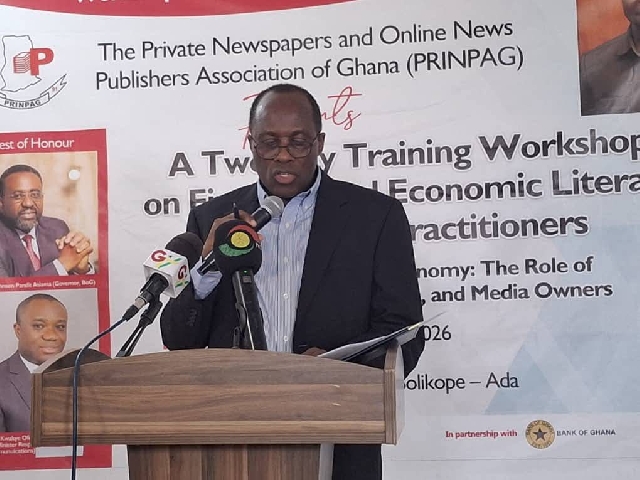

Dr Francis Yao Kumah

Dr Francis Yao Kumah

The Governor of the Bank of Ghana (BoG), Dr Johnson Pandit Asiama, has underscored the critical role of journalists, publishers and media owners in consolidating Ghana’s economic recovery and anchoring public confidence as the country enters a new phase of stability.

Delivering a keynote address at a capacity-building workshop organised by the Private Newspapers and Online Publishers Association of Ghana (PRINPAG) at the Peace Holiday Resort in Solikope, Ada, the Governor’s message was presented on his behalf by Dr Francis Yao Kumah, Advisor to the Governor.

The workshop, held on January 24, 2026, was themed “Resetting the Economy: The Role of Journalists, News Publishers and Media Owners.”

Dr Asiama noted that Ghana entered 2026 on a stronger footing following what he described as a year of “discipline, consistency and credibility” in 2025.

He highlighted key economic gains, including a sharp decline in inflation from 23.8 per cent in December 2024 to 5.4 per cent by December 2025, improved stability in the foreign exchange market, and gross international reserves exceeding US$13.9 billion, representing about 5.7 months of import cover.

He also cited major institutional reforms, such as the passage of the Bank of Ghana (Amendment) Act, 2025, progress in digital finance and payments systems, a more rules-based foreign exchange auction framework, and the Bank’s gold programme, which helped strengthen external buffers and investor confidence.

According to the Governor, while stability has been achieved, it should be viewed as a foundation rather than an end in itself.

“Stability is not the destination — it is the launchpad,” he stated, explaining that resetting the economy requires a reset of expectations, institutions and behaviours, including within the information ecosystem shaped by the media.

Dr Asiama stressed that economic reporting carries significant weight, as it can influence market behaviour, investor sentiment and household decisions.

He identified the media as a critical anchor of confidence and clarity, particularly in explaining complex and sometimes counterintuitive monetary and financial policies.

He outlined three key functions of a responsible and independent media during the reset phase: providing context to economic data and policy choices, scrutinising institutions constructively to enhance accountability, and countering misinformation to stabilise public expectations.

Touching on the Bank’s priorities for 2026, the Governor said the year would focus on consolidation and discipline, with emphasis on orderly foreign exchange and money markets, resilient and well-regulated payment and digital finance systems, preventive supervision of financial institutions, and clear, predictable policy communication.

He urged journalists and publishers to deepen economic literacy, uphold the integrity of the information ecosystem, practise evidence-based accountability, and support rules-based financial markets and responsible innovation.

“As journalists break down inflation dynamics, interest rate paths and FX market norms into accessible stories, citizens engage with confidence rather than fear,” he noted.

Dr Asiama also announced a series of initiatives aimed at strengthening collaboration between the Bank of Ghana and the media.

These include expanded specialised training programmes on monetary policy and financial stability, the introduction of a regular Editors’ and Producers’ Forum, and the launch of the Governor’s “Economic and Financial Story of the Year” Award, which will sponsor the winning journalist to attend the IMF/World Bank Meetings.

He reaffirmed the Bank’s commitment to openness and proactive engagement, pledging timely clarifications, background briefings and access to authoritative data for media houses.

“Resetting the economy is not the work of one institution,” the Governor said, adding that an informed public, disciplined markets and consistent policy are essential to making stability durable.

He called on the media to work with the Bank of Ghana to reset expectations, reinforce institutions and reshape behaviours, so that recent gains translate into lasting prosperity for the country.

Source: Classfmonline.com/Cecil Mensah

Trending News

Nana Kwame Bediako disputes UK court judgment over alleged $14.9m debt

16:40

For the sake of the soul and spirit of NPP, vote Bryan Acheampong -Yeboah to delegates

17:32

African Trade Chamber appoints Bahamian Senator Barry Griffin to board

00:57

NAiMOS officer shot, armed assailant killed during anti-galamsey operation in Bono Region

07:53

A-Plus urges Ghanaians to keep NPP in opposition to “learn governance”

11:47

MoH orders investigation into Fourth Estate report on Ridge Hospital

14:32

PRESEC condemns labelling school as breeding ground for homosexuals

11:57

COCOBOD CEO must account for costs after case dismissal -Edem Senanu

16:42

IGP Special Operations Team arrests military officers for possession of substances suspected to be Indian hemp in Tamale

17:19

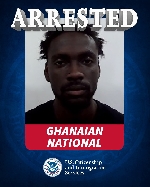

US authorities arrest individual described as “Ghanaian alien” over criminal history

00:15