Bank of Ghana holds post-MPC engagement with bank CEOs after 127th meeting

Dr Johnson Asiama, Central bank governor

Dr Johnson Asiama, Central bank governor

The Bank of Ghana on Tuesday, December 16, 2025, held its post–Monetary Policy Committee (MPC) meeting with chief executives and heads of banks, following the conclusion of the 127th MPC meetings.

In his opening remarks, the Chairman of the MPC and Governor of the Bank of Ghana, Dr. Johnson P. Asiama, outlined recent macroeconomic developments and explained the policy decisions taken by the Committee.

“It is always a privilege to meet with you following our Monetary Policy Committee deliberations.

These moments of engagement remind us that beyond macroeconomic indicators and policy instruments lies a shared mission – the service to the Ghanaian people and a collective responsibility to build a resilient, inclusive, and prosperous economy,” Dr. Asiama said.

The Governor highlighted key prudential and regulatory directives aimed at strengthening financial sector stability and aligning Ghana’s banking system with international best practices.

He referenced the recent reduction in the policy rate by 350 basis points, noting that it reflects improving macroeconomic conditions, including a sustained downward trend in inflation.

Dr. Asiama also pointed to the resilience of the banking sector and strong economic growth as indicators of the effectiveness of ongoing reforms and prudent policy management.

Looking ahead, the Governor announced several initiatives the central bank plans to roll out to further enhance the robustness of the financial system.

These include the issuance of new directives on stress testing, recovery planning, and risk management, as well as the implementation of a revised Risk-Based Supervisory Framework.

The new framework will focus on business risk, financial resilience, risk governance, and operational resilience.

He further emphasised the Bank of Ghana’s commitment to deepening collaboration with other financial regulators and industry bodies to promote systemic stability and build a more resilient financial sector.

“These reforms reflect our vision – a banking sector that is modern, competitive, resilient, and capable of supporting Ghana’s long-term growth agenda,” the Governor added.

Source: Classfmonline.com/Cecil Mensah

Trending News

NDC extends Christmas and New Year greetings, reaffirms commitment to governance mandate

14:51

PAOG opens dedicated communication lines for Hajj 2026 enquiries

00:55

Dr Opoku accuses Fourth Estate and Sulemana Briamah of misrepresentation in KGL-NLA deal

05:47

Concerned NDC members in Larabanga petition President Mahama over marginalisation

18:05

Housing Project: President Mahama launches Oxygen City in Volta, reaffirms commitment to equitable regional development

23:20

Public outcry grows over silence on October 2024 fatal East Legon accident case

13:54

Don't bring back Dr Bawumia - Political Scientist warns NPP delegates

00:28

V/R: Bee attack on Anloga EP Basic School leaves 2 dead

03:14

Environmental Protection (Mining in Forest Reserves) Revocation Instrument takes effect after 21 days

17:47

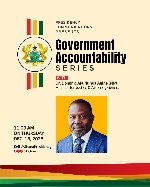

'Government Accountability Series': Attorney General, Justice Minister speaks tomorrow Dec 18

20:02